Streamlining Your Business with Odoo 18's Electronic Invoicing (EDI)

In today's fast-paced digital landscape, businesses are continually seeking ways to enhance efficiency and ensure compliance with evolving regulations. Odoo 18 introduces robust Electronic Data Interchange (EDI) features, empowering companies to seamlessly manage electronic invoices and other business documents.

Understanding Electronic Invoicing (EDI)

EDI facilitates the electronic exchange of business documents, such as purchase orders and invoices, between companies in a standardized format. This ensures that the receiving system can accurately interpret the information, leading to streamlined operations and reduced errors. Various EDI file formats are available, tailored to specific country requirements.

National Electronic Invoicing Compliance

For businesses operating in countries with specific e-invoicing mandates (e.g., Italy, Spain, Mexico), Odoo 18 allows the configuration of default e-invoicing formats for sales journals. By navigating to Accounting -‣ Configuration -‣ Journals, selecting the sales journal, and enabling the required formats under the Advanced Settings tab, companies can ensure compliance with national regulations.

Generating E-Invoices in Odoo 18

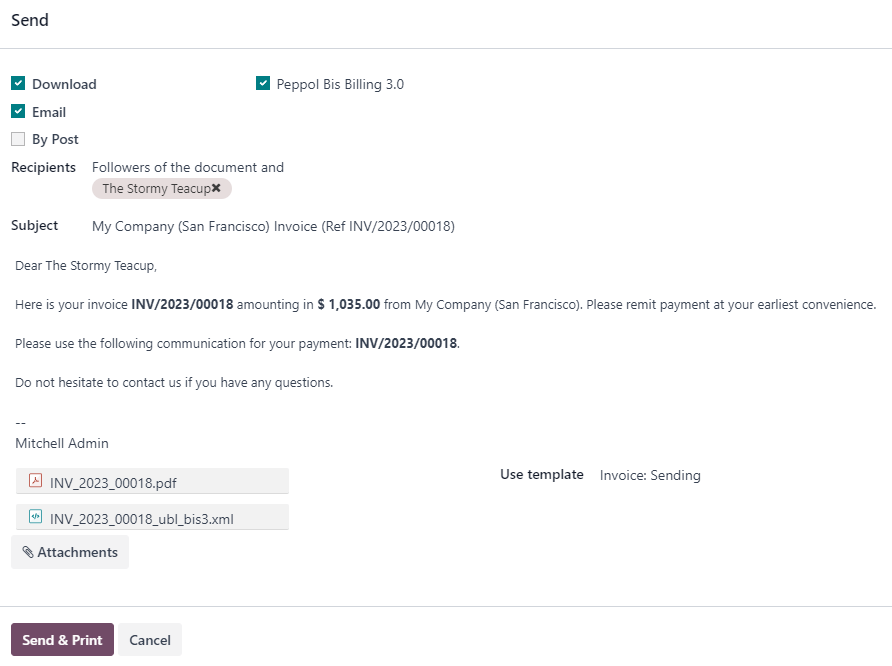

Creating an e-invoice in Odoo 18 is straightforward:

Confirm the invoice.

Click on Send & Print to open the send window.

Select the e-invoicing option to generate and attach the e-invoice file.

This process ensures that your invoices are electronically formatted and ready for compliant transmission.

Leveraging Peppol Integration

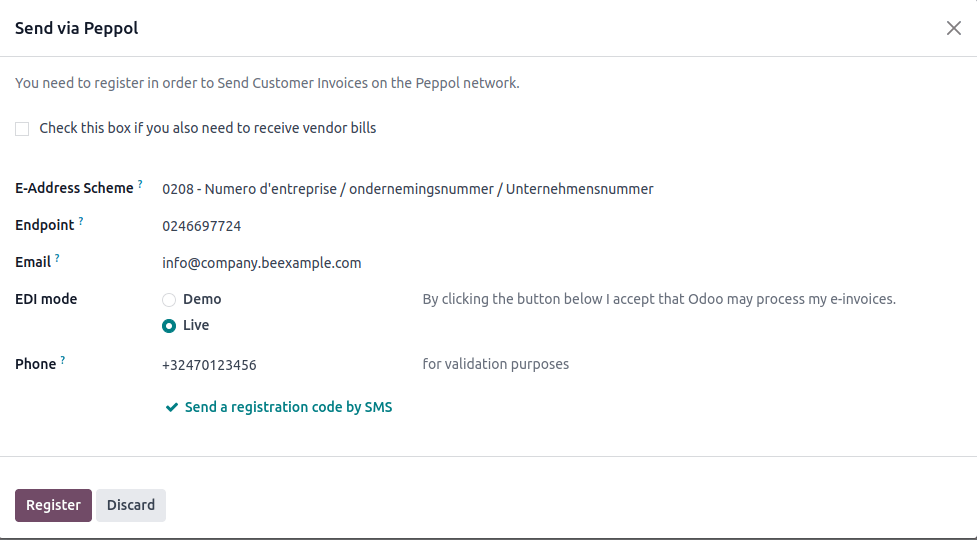

Odoo 18 serves as both an access point and a Service Metadata Publisher (SMP) for the Peppol network—a standardized platform facilitating document exchange between enterprises and governmental authorities. This integration allows businesses to send and receive electronic documents without relying on traditional email or postal services.

Key Features of Odoo's Peppol Integration:

Free Registration: Peppol registration is free and available within the Odoo Community.

Comprehensive Document Handling: Send customer invoices and credit notes, and receive vendor bills and refunds via Peppol.

Supported Formats: Odoo supports document formats like BIS Billing 3.0, XRechnung CIUS, and NLCIUS.

Eligible Countries: Peppol registration in Odoo is available for numerous countries, including Andorra, Austria, Belgium, France, Germany, Italy, Netherlands, Spain, and many more.

Verifying Peppol Participants

Before transmitting an invoice via the Peppol network, it's essential to verify that the recipient is a registered Peppol participant:

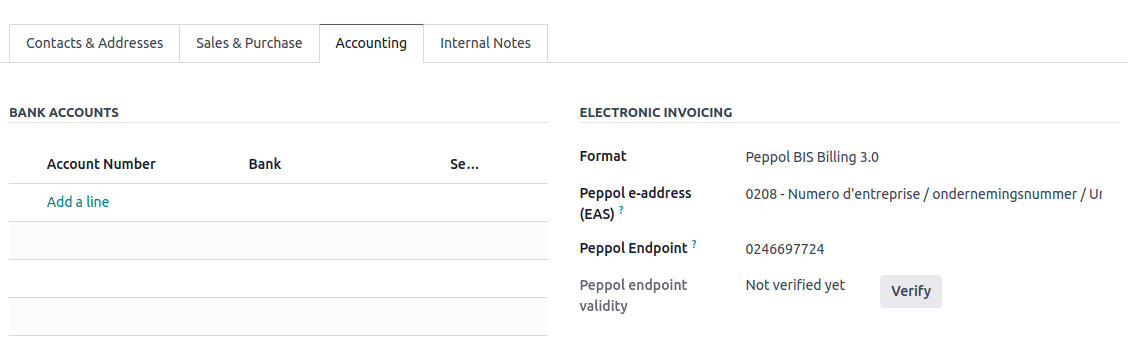

Navigate to Accounting -‣ Customers -‣ Customers and open the customer's form.

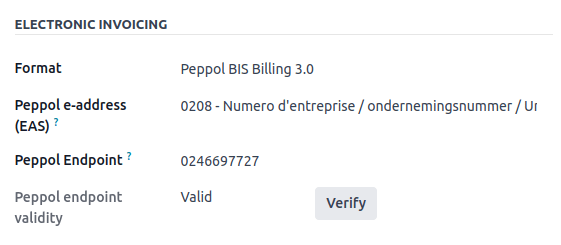

Go to the Accounting tab -‣ Electronic Invoicing.

Select the appropriate format and ensure the Peppol EAS code and Endpoint are filled in.

Click Verify.

A successful verification confirms the customer's registration on the Peppol network, facilitating seamless electronic invoicing.

Sending Invoices via Peppol

To dispatch an invoice through the Peppol network:

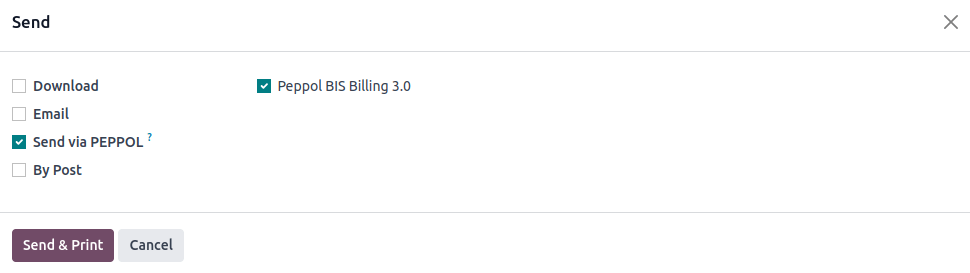

Open the invoice form.

Click Send & Print.

Ensure both the BIS Billing 3.0 and Send via PEPPOL checkboxes are selected.

For batch processing, select multiple invoices in the list view and choose Actions ‣ Send & Print; they will be queued and sent collectively.

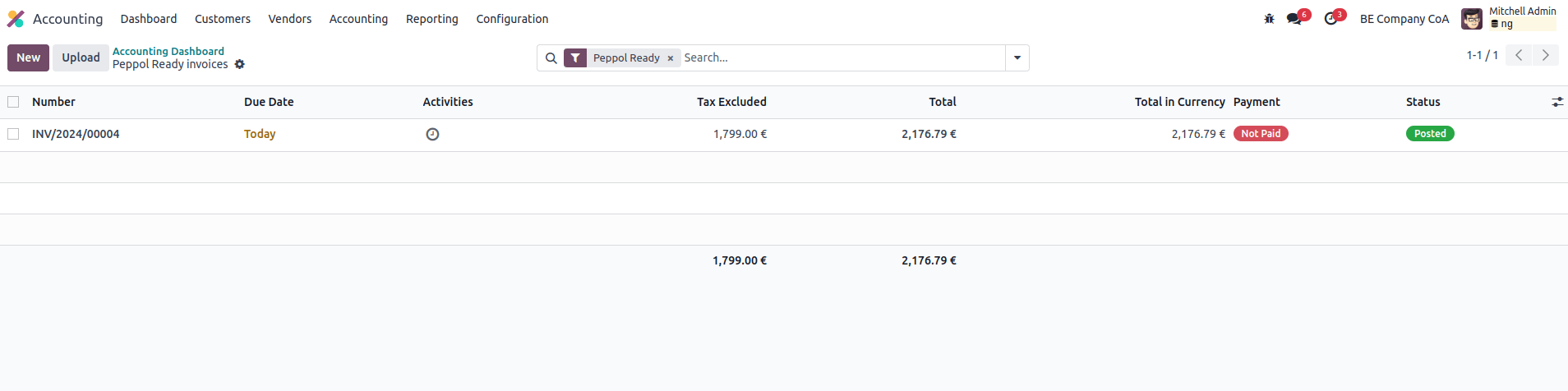

Posted invoices that can be sent via Peppol are marked as Peppol Ready. To display them, use the Peppol Ready filter or access the Accounting dashboard and click Peppol ready invoices on the corresponding sales journal.

Once the invoices are sent via Peppol, the status is changed to Processing. The status is changed to Done after they have been successfully delivered to the contact’s Access Point.

Embracing the Future of Invoicing with Odoo 18

By integrating comprehensive e-invoicing capabilities and Peppol network access, Odoo 18 positions businesses to enhance operational efficiency, ensure compliance with international standards, and streamline financial workflows.Adopting these features enables companies to stay ahead in the evolving digital economy.